In today’s fast-paced digital economy, credit cards have become an essential tool for managing personal finances. From online shopping to emergency expenses, a credit card offers convenience, flexibility, and rewards that traditional payment methods often can’t match. But how do credit cards work, and what do you need to know about making payments? Let’s break it down in simple terms.

What is a Credit Card?

A credit card is a plastic or metal card issued by a bank or financial institution that allows you to borrow money up to a pre-approved credit limit to pay for goods or services. You’re essentially using the bank’s money and paying it back later—either in full or over time.

Every credit card has:

- Credit limit – the maximum amount you can spend

- Interest rate (APR) – the cost of borrowing if you don’t pay in full

- Minimum payment – the smallest amount you must pay each month

- Billing cycle – the time between statements (usually 30 days)

How Credit Card Payments Work

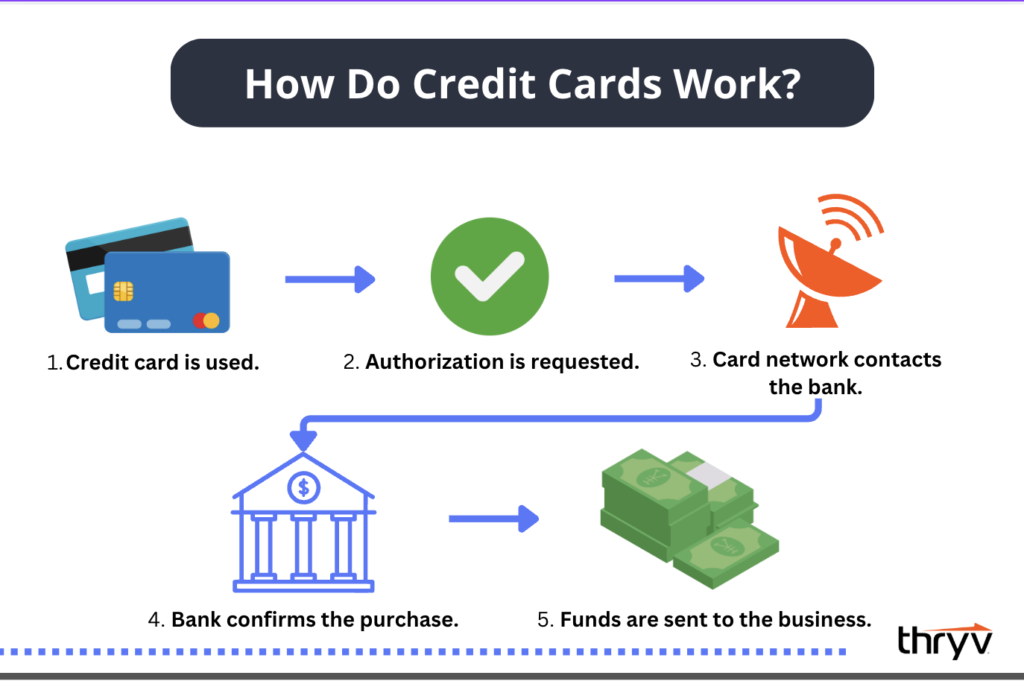

When you use your credit card, you’re borrowing money. Here’s what happens next:

1. Transaction is Approved

When you swipe, tap, or enter your card online, the credit card company checks if you have available credit. If yes, the transaction goes through.

2. Statement is Generated

At the end of your billing cycle, the credit card issuer sends you a statement listing:

- All your purchases

- Total amount due

- Minimum payment due

- Payment due date

3. Making a Payment

You have several options:

- Pay in full: Best choice! You avoid all interest charges.

- Pay minimum only: This keeps your account in good standing, but you’ll pay high interest on the remaining balance.

- Pay partially: You reduce your balance but still incur some interest.

4. Interest Charges

If you don’t pay the full amount by the due date, interest (called APR, or annual percentage rate) is added. Credit card interest can range from 15% to 30%, so it can grow fast!

Types of Credit Card Payments

- Online Payments: Through your bank or the card issuer’s app or website

- Auto-Pay: Automatically deducts the minimum or full amount from your account

- Phone Payments: Call your issuer and pay over the phone

- In-Person: Visit your bank and pay at the counter

Tips to Manage Credit Card Payments Wisely

- Pay on Time: Late payments hurt your credit score and incur late fees.

- Pay in Full: Avoid interest by clearing your full balance each month.

- Don’t Max Out: Try to use only 30% or less of your credit limit.

- Monitor Statements: Check for errors or unauthorized charges.

- Set Alerts: Many apps let you set reminders for due dates.

Benefits of Using a Credit Card

- Build Credit History: Responsible usage improves your credit score.

- Earn Rewards: Cashback, points, and travel miles.

- Purchase Protection: Many cards cover lost or damaged items.

- Emergency Fund: Use it when you’re short on cash.

Common Credit Card Mistakes to Avoid

- Paying just the minimum

- Missing due dates

- Applying for too many cards

- Not reading terms and conditions

- Ignoring interest rates

Final Thoughts

Credit cards are powerful financial tools—but only when used responsibly. Understanding how credit card payments work can help you avoid debt, save money on interest, and even improve your financial health. Always pay on time, track your spending, and choose a card that fits your needs.